- Ann Arbor Public Schools

- 2017 SpEd Renewal FAQs

2017 Special Education Millage Renewal FAQs

-

- What is the question before voters?

On Tuesday, November 7, 2017, voters in our Ann Arbor Public Schools community will see a question on their ballots to renew the Washtenaw ISD Special Education Millage approved by voters in 2011, currently at 0.9719 mills. Your tax rates won’t increase over 2017 rates as a result of this request.

The purpose of the Special Education Millage is to cover unreimbursed costs to provide special education services in Washtenaw County.

- Have we paid this tax before?

Yes. This millage question was previously approved by voters in 2011. The question before the voters on November 7th is whether to renew the previously existing millage.

- For which students and programs does this Special Education Millage provide benefit?

This Special Education Millage provides benefits to all students in the district because it allows that General Fund dollars that would otherwise be used to cover the costs of mandatory special education services to be available to fund programs for all students.

This 0.9719 renewal represents approximately $6 million annually for the Ann Arbor Public Schools.

Achieving this millage renewal will allow the costs of special education services to be reimbursed, allowing more General Fund dollars to be used for other valued purposes and programs across the district.

- How many students receive special education services in Ann Arbor Public Schools? In Washtenaw County?

Approximately 2,000 students, or 1 in 9, in the Ann Arbor Public Schools receives special education services as documented in their Individual Education Plan (IEP) and student needs range from mild to significant in nature.

Over 6,500 students, or 1-in-7 across Washtenaw County school districts, receive services as a result of a documented Individual Education Plan (IEP). Local districts are mandated to provide special education services to students, ages 0 to 26 in Michigan, who have Individual Education Plans.

- What types of disabilities qualify for services?

There are 13 eligibility categories covered under the current Federal Individuals with Disabilities Education Act (IDEA). The list includes: autism, deaf/hearing impairment, blind/visual impairments, cognitive impairments, early childhood developmental delays, emotional impairments, physical impairments, speech & language impairments, specific learning disabilities, severe multiple impairments, traumatic brain injury, other health impairments (chronic or acute conditions).

- It seems like I remember another Special Education Millage. What did voters approve in 2016?

In May 2016, voters approved a 1.5 mill increase for Special Education Millage to help cover significant unreimbursed costs to provide special education services to students in Washtenaw County.

- How much money will the renewal, if approved, generate for Ann Arbor Public Schools?

Based on the previous five-year trends, this proposed renewal would provide for approximately $6 million dollars for Special Education annually from this millage, relieving the General Fund of that burden.

These kinds of local millage funds provide a critical revenue source not subject to possible changes or fluctuations in state or federal funding.

- If approved, when will this millage renewal expire?

This renewal will expire in 2025. The millage that was approved by voters in 2016 and this .9719 renewal mill will expire at the same time.

- How much money will the renewal, if approved, generate for Washtenaw County school districts collectively?

Washtenaw County school districts receive approximately $15 million annually.

- What is the annual cost of providing special education services in the Ann Arbor Public Schools and how are these services funded?

Funding for special education services in the AAPS has historically been provided via local, state, and federal funds, including the district’s General Fund.

In 2016 specifically:

Estimated cost of AAPS special education services $48M Less: Federal Reimbursement ($3M) State Reimbursement ($13M) Local (WISD) Reimbursement ($26M) (from ALL WISD reimbursements) Projected Reimbursements $42M AAPS General Fund Impact after reimbursements $ 6M Over the years, local, state, and federal funding have provided for only a portion of what is actually expended in providing the important and legally required services.

- What is the annual cost of providing special education services in the county?

Approximately $124 million. These costs have steadily increased and funding from the state and federal government has not kept pace with expenses. The special education millage being voted on can only be used to cover the eligible special education costs not currently reimbursed by federal and state funding, or by the existing special education millage. Local districts and public charter schools use general fund dollars to cover any unfunded special education costs.

- Are the taxes collected for the Special Education Millage sent directly to Lansing and distributed to schools across the state?

No. Washtenaw ISD collects and distributes the Special Education tax revenues to our public schools within the Washtenaw ISD boundaries (nine public school districts and 14 public school academies, aka charter schools).

- Can Special Education Millage tax dollars be used for other school expenditures?

No. Funding designated for special education services can only be used for costs related to educating students with Individualized Education Plans (IEPs). This includes paying for both the personnel and the services provided for these students.

- Does the Washtenaw Intermediate School District (WISD) make the decision on how special education funds will be spent in each district?

Washtenaw ISD does not have authority or control over the spending of local districts and public charter schools (each have their own school boards). Special education spending is determined first by the child’s needs, as detailed in the Individual Education Plan (IEP). The governing boards of education and school administration at each district approve district budgets.

Funding received from the Special Education Millage is used by Washtenaw ISD to reimburse local public schools for a portion of their eligible special education costs and to operate some special education programs, services, and supports on behalf of the local public schools.

- I understand that this Special Education Millage renewal is not an increase in tax rates over what we are paying in 2017. Would you clarify what 0.9719 mill represents for an average homeowner?

This renewal millage represents approximately $4 per month, or just under $1 a week per $100,000 of home market value. The chart below provides additional calculations:

Per Market Value Taxable Value Monthly Cost Annual Cost $100,000 $50,000 $4.05 $48.60 $150,000 $75,000 $6.07 $72.84 $200,000 $100,000 $8.10 $97.20 $300,000 $150,000 $12.15 $145.80 - When is the millage election?

Tuesday, November 7, 2017

- Who is eligible to vote?

Registered voters who are residents in the school districts of Ann Arbor, Chelsea, Dexter, Lincoln, Manchester, Milan, Saline, Whitmore Lake, and Ypsilanti.

- Where can I obtain more information?

If you should need more information, please see our a2schools.org website, attend one of many upcoming school/community meetings coming up during October, or reach out directly to your school principal or to Superintendent Swift at swift@a2schools.org.

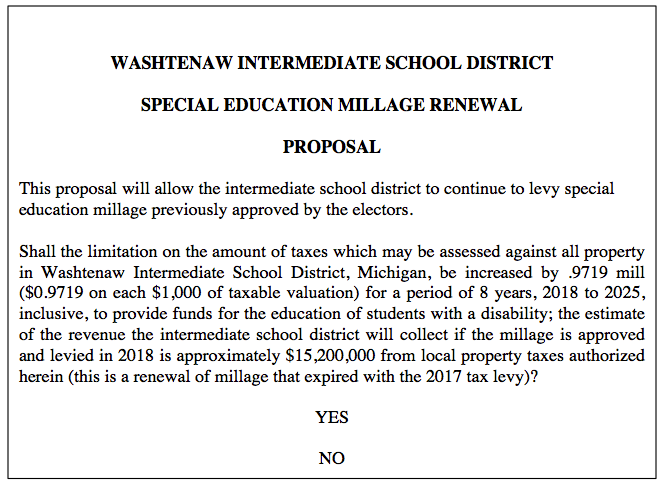

- What does the ballot look like?

While the ballot states “increase” the proposal would renew and continue the rate levied in 2017.